The case for uranium today is perhaps the strongest it’s been in a decade. The 2011 Fukushima Daiichi nuclear disaster in Japan resulted in a lengthy setback for uranium, as plans for nuclear power development were tabled globally and uranium’s use became a highly contested issue. Persistent oversupply kept prices down and the sentiment around uranium muted. But a decade later the case for uranium is strengthening as countries prioritize climate change agendas and limiting carbon emissions, while seeking to distribute power to millions of new entrants to the middle class. With supply and demand dynamics becoming more favorable and geopolitical risks supportive, we believe uranium may see its fortunes turn over the next decade.

Key Takeaways:

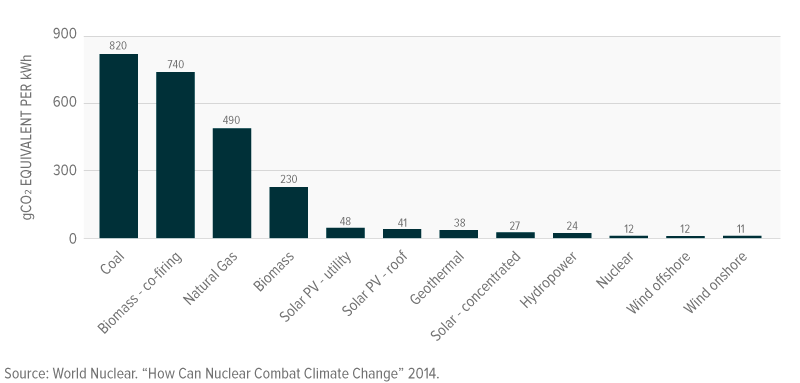

- Nuclear power emits nearly 70 times less carbon dioxide than coal, making it significantly less intensive carbon source than fossil fuels

- The world’s largest uranium mine, Cigar Lake, is closed, and the world’s largest uranium producer, Kazatomprom, pledged to extend its 20% production cuts through 2022, shifting the market dynamics to support higher prices

- The Global X Uranium ETF (URA) offers efficient access for investors to access the uranium industry

Fossil Fuel Reductions Set to Keep Uranium Demand High

Nuclear power, as a low carbon emissions energy option, is the biggest source of uranium demand globally. Nuclear power emits far less carbon dioxide than traditional fossil fuels, with emissions of just 12 grams of CO2 per kW/h – the same as offshore wind energy.1 By comparison, coal emits a staggering 820 CO2 per kW/h.2

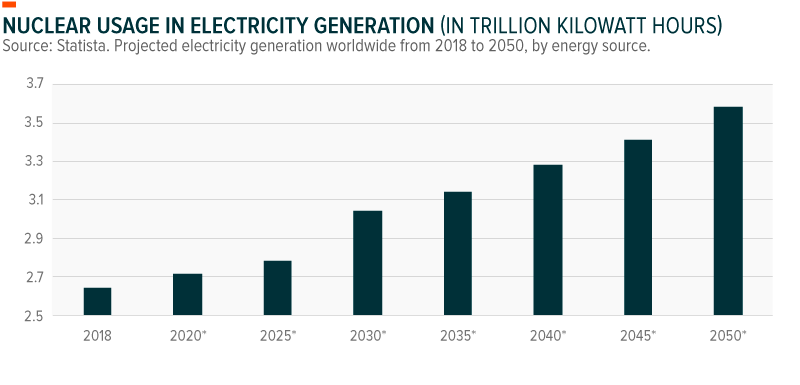

Growing social and political pressure for countries to lower their fossil fuel footprint is one reason why global electricity generation through nuclear is expected to increase by 650 TWh from 2019 to 2040, compared to growth of just 210 TWh from 2000 to 2019. Only wind and solar are expected to have a higher growth rate in electricity generation than nuclear from 2019-2040 compared to the 2000-2019 period.3 Nuclear power’s share of electric generation is 10% today, but it’s mostly in lower-growth, developed markets like the US and Europe.4

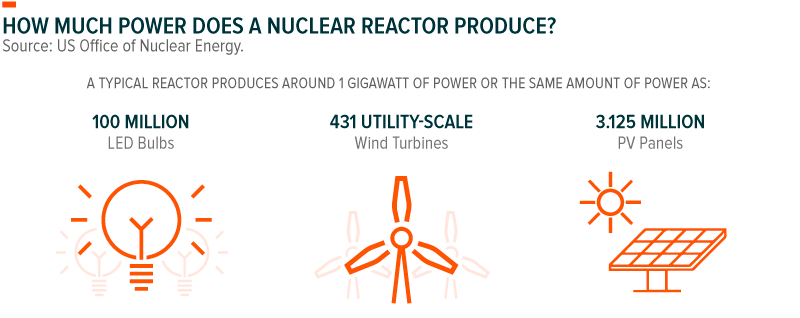

China is expected to be a major source of uranium demand in the future. China’s share of domestic electricity usage from nuclear power increased from 2% to 5% from 2009 to 2019.5 The country is also ahead on its mission to reduce fossil fuel emissions, with a 2060 goal of reaching carbon neutrality, meaning net-zero carbon emissions.6 Of the 53 nuclear reactors currently under construction globally, China leads the way with 16, followed by India with 6.7 Nuclear is something of a trend in Asia, as the broader region accounts for about 60% of the new reactors under construction. Nuclear power plants do not cause air pollution while in operation, and can bring massive power supply on line compared to standard wind and solar projects. Nuclear’s output capacity is around 2.5 to 3.5 times more than a typical wind or solar project.8 For populous, fast-growing countries like China and India, that also suffer from devastating pollution, nuclear is a critical energy source.9 Nuclear reactors can also be a more efficient energy source than renewables. According to the US government, a typical nuclear reactor can produce as much power as either 431 utility scale wind turbines or 3.1 million solar panels.

Mining Closures, Production Cuts Keeping Supply in Check

On the supply side of the equation, uranium output has reached a decade-plus low in the wake of the COVID-19 pandemic. Cigar Lake, a Canadian mine run by uranium giant Cameco, shut down in December 2020 due to COVID.10 It was the second time Cigar Lake shut down last year.11 Cigar Lake was responsible for 13% of global uranium production in 2019.12 Also, Kazakhstan’s state-owned Uranium mining company, Kazatomprom, extended production cuts by 20% into 2022, citing a market stuck in oversupply.13 Kazatomprom accounts for 22% of the global uranium supply.14

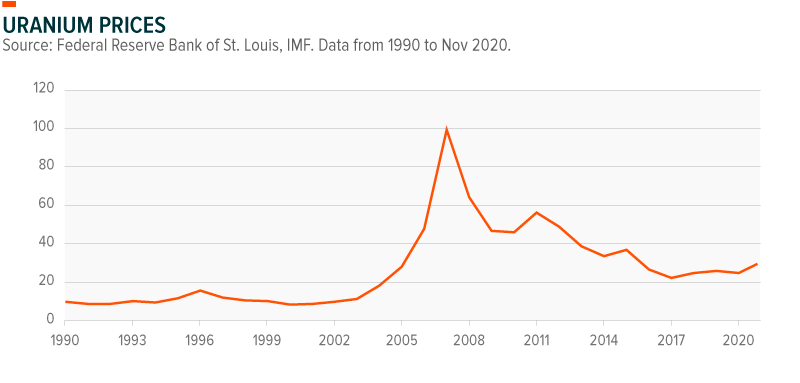

Uranium prices were in a prolonged slump after the Fukushima disaster, but the supply/demand dynamics are leveling out, due in part to Kazatomprom’s cuts. The move can be likened to Saudi Arabia’s decision in the oil markets to cut supply in order to support higher prices. Prices are still depressed compared to the $100/lb prices seen in 2007, but for the first time in a long time, there are signs of a recovery.

Uranium Remains Sensitive to Geopolitics

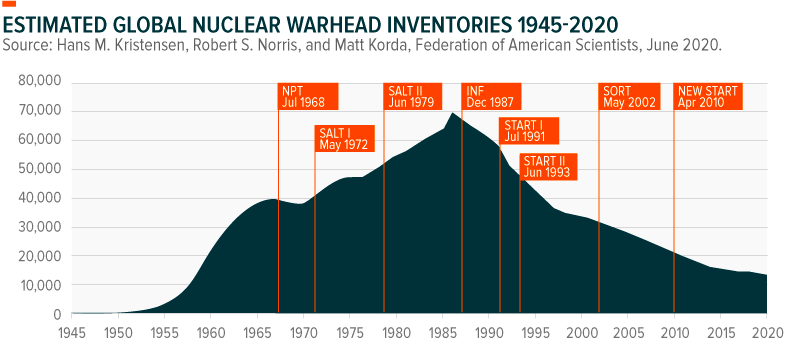

Nuclear power generation may be the largest source of uranium demand, but uranium’s use in military and defense remains significant. Globally, military stockpiles account for seven times annual uranium mining production, with the US and Russia maintaining the largest arsenals.14 And that’s a major reason why uranium is particularly sensitive to geopolitics. The 2015 nuclear pact between Iran and the UN Security Council (China, France, Russia, the UK, and the US) along with Germany is a case study.

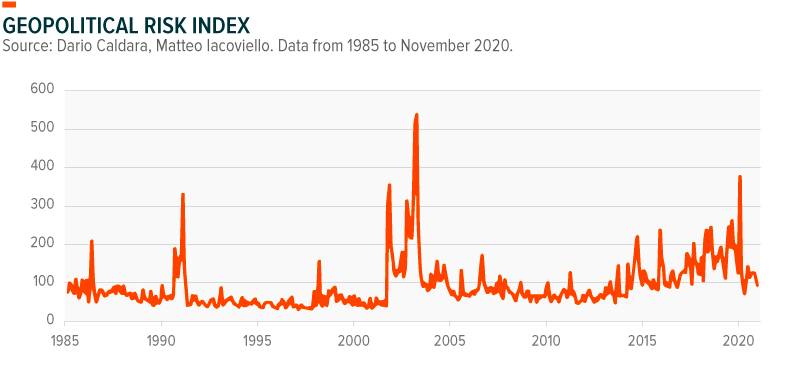

The deal was viewed as a longer-term attempt to de-escalate tensions between Iran and the West. Iran essentially agreed to limit its nuclear capabilities and to have its nuclear facilities monitored. In exchange, nuclear-related economic sanctions previously imposed on Iran would be lifted. But the US withdrew from the deal in May 2018, and geopolitical and trade tensions increased globally. Tensions reached a peak in January 2020 when the US targeted one of Iran’s top military generals with a drone strike. The subsequent spike in the Geopolitical Risk Index was the largest since the US’ invasion of Iraq in 2003.

Nuclear weapons inventories have been on a steady decline since the end of the Cold War. But Iran and North Korea continue to seek global influence through enhancing their nuclear capabilities, further straining their relations with the US and the West. Currently, North Korea has an estimated 30–40 nuclear weapons and analysts estimate Iran is possibly a year away from having its first weapon.15

Increased nuclear pursuits can increase demand for uranium, and thus prices. In early 2021, it was revealed that Iran increased its nuclear enrichment levels to 20%, much higher than the 4–5% limit imposed by the 2015 nuclear agreement. For perspective, nuclear weapons enriched to over 90% U-235 contain up to 25 times the amount in nuclear reactor fuel.16 The pandemic skewed the effect on the uranium market, but prices rose 18% year-over-year through November 2020, a year in which relations between Iran and the West deteriorated significantly.17

How to Invest in Uranium

Uranium’s appears primed for a rebound in 2021 and beyond. Working in uranium’s favor is the long-term shift to cleaner energy, like that brought by nuclear power, and market imbalances created by supply cuts and geopolitical tensions, which are unlikely to abate anytime soon. In our view, these factors make a compelling investment case for uranium prices to rise after a decade of declining prices.

We believe investing in uranium through the Global X Uranium ETF (URA) offers an efficient method for accessing a broad basket of companies involved in uranium mining around the world. Trading uranium derivatives can be more challenging than other commodities because futures and derivatives contracts often lack liquidity. Therefore, exposure to uranium through equities can potentially provide more efficient exposure to the space. URA includes a basket of uranium companies that could benefit from higher uranium prices including uranium mining and exploration companies, as well as those with substantial uranium investments or technologies related to the uranium industry.

Related ETFs

URA: The Global X Uranium ETF (URA) provides investors access to a broad range of companies involved in uranium mining and the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries.

Rohan Reddy

Rohan Reddy